Simple Info About How To Reduce Share Capital

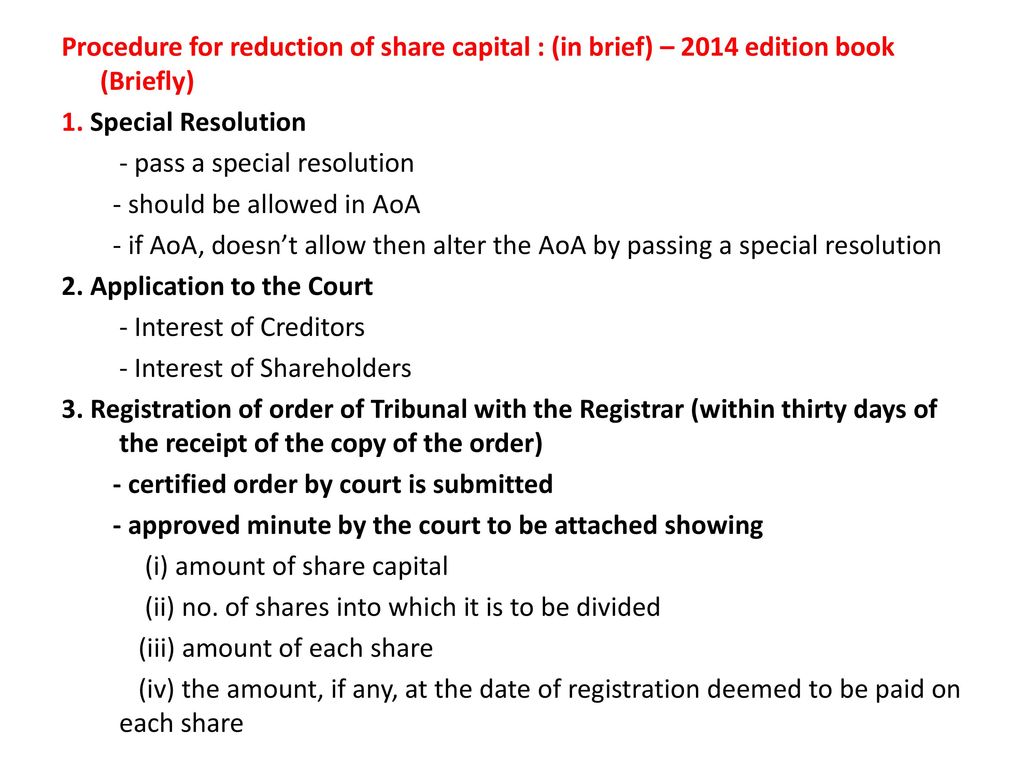

How to make a capital reduction?

How to reduce share capital. A company is required to reduce its share capital using a set of specific steps. This form can be used as a statement of capital by a private limited company reducing its capital supported by a solvency statement. How can you reduce your company’s share capital?

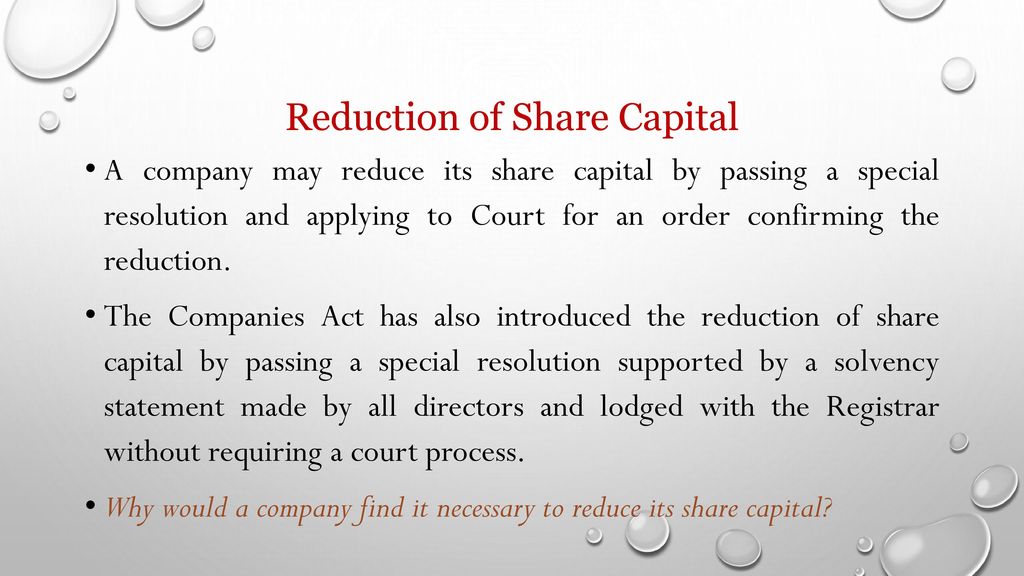

A public companymay only reduce its capital with court approval. Even if the special resolution is passed, the court must approve the. How a reduction of share capital can be structured.

A company may want to reduce its share capital for various reasons, including to create distributable reserves to pay a dividend or to buy back or redeem its own. First, a notice must be sent out to creditors of the resolution of the capital reduction. Methods to reduce share capital:

Cancelling share capital no longer supported by the. Reducing share capital with the approval of the court a special resolution for share capital reduction. (b) filing an order of court.

Pass a special resolution and confirmation by the court (section 116) b. Pass a special resolution supported by a solvency statement (section 117). Members’ approval follow these steps if your.

The date for the shareholder’s. You can reduce share capital to a minimum of 1 issued share and the usual practice for share capital reductions is for them to be pro rata across all members. Section 256b (1) of the corporations act provides that a company may reduce its share capital in a way that is not otherwise authorised by the corporations act if.